Abstract

This paper investigates the notion of peer-to-peer (P2P) insurance, a risk-sharing model where individuals pool resources to protect against potential risks. We analyze the positive effects of P2P insurance, including lower costs, aligned incentives, and community building. Our research juxtaposes P2P insurance platforms with traditional insurance models, revealing distinct characteristics such as lower premiums, higher user satisfaction, and faster payouts. Additionally, we pinpoint challenges, including regulatory hurdles and potential conflicts of interest. Case studies of Lemonade,

Friendsurance, and Guevara demonstrate the potential of P2P insurance to disrupt traditional models and create a more inclusive approach to risk management. Our empirical analysis highlights the importance of policyholder age and location in influencing claims frequency and severity. This paper enriches our understanding of P2P insurance and its potential to transform the insurance industry, offering insights for policymakers, consumers, and insurers seeking innovative solutions. P2P insurance offers several benefits, including lower costs, aligned incentives, profit sharing, and improved claims experiences. As P2P insurance continues to evolve, it presents a compelling alternative to traditional models, aiming to increase efficiency, reduce costs, and foster a sense of community among policyholders.

Keywords: Insurance, Digital service, Peer 2 Peer, two-sided platform, market design, Internet marketing, sharing economy, e-commerce, Risk Sharing

I. Introduction

Definition of peer-to-peer insurance:

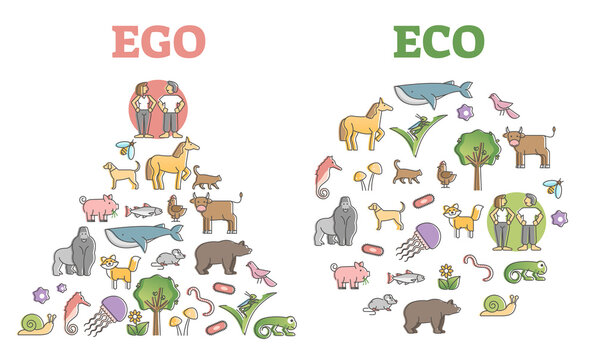

A risk-sharing network is essentially a group of individuals who pool their money to protect themselves against potential risks. This collective pooling of resources helps to spread the financial burden of any individual’s loss across the group.

Overview of the traditional insurance industry:

In the traditional insurance industry, the product offered is a promise of protection and financial security. There are hundreds of potential risks that individuals and businesses face, for which they may seek insurance protection. These risks are broadly divided into three categories: property and casualty (PNC), life, and health. PNC and health are sometimes called nonlife insurance, and PNC specifically is also called general insurance. PNC: Property includes things like cars and buildings, while business casualty, otherwise known as liability, covers your responsibilities to others you might have to pay because of something you did or failed to do.

The value of the property is fixed, so the maximum cost or exposure is defined in the policy. The uncertainty is so great that it is impossible to foresee all potential outcomes. Most insurance policies include personal and commercial. You can buy an umbrella or access liability policy and many other types of personal policy. For example, pet travel insurance, buildings, and risks appear in commercial policies and a range of risk-specific businesses.

Property risks include companies, stock assets, and also financial loss due to business interruption or customers not paying under casualty; most service businesses need professional liability insurance, otherwise known as errors and Omissions or professional indemnity to failure to deliver or damage caused. If there is a failure to deliver or damage cost, the exact risk differs by profession. How big the claims are for property risk, liability risk may play out at any time in the future, but as each year passes, insurance companies could be increasingly confident about the size of any future claims. They will need to pay out.

Benefits of peer-to-peer insurance:

Lower Costs, Aligned Incentives, Profit Sharing, Community Building, Customization, Transparency, Improved Claims Experience and Encouragement of Responsible Behaviour.

II. History and Evolution of Peer-to-Peer Insurance

Origins: Mutual insurance dates back to ancient societies, where communities pooled resources to cover losses. The Friendly Societies of 18th-century England and the Mutual Aid Societies in the US are early examples.

Modern Evolution: The internet and digital technologies have revived mutual insurance, enabling the creation of platforms that facilitate P2P insurance. Friendsurance, founded in Germany in 2010, is often cited as the first modern P2P insurance platform. Lemonade, launched in 2015 in the US, uses AI and behavioural economics to enhance the model.

How P2P Insurance Works:

Formation of Groups: Policyholders form small groups based on similar risk profiles or social connections.

Pooling of Premiums: Premiums are pooled together in a communal pot.

Claims Process: When a claim is made, it is paid out from the pooled funds. Any remaining funds at the end of the period may be refunded or rolled over.

III. Key Features and Characteristics

Decentralized and distributed models: Peer-to-peer insurance is not just a system, it’s a movement that empowers individuals to pool their resources directly and address shared risks collectively. This model emphasizes community involvement and transparency, often granting members a say in the claims process, making them feel engaged and influential.

Core Principles of Decentralized Insurance: Transparency, Security and Efficiency

The benefits of Decentralized Insurance Platform Development are accessibility, Inclusivity, Lower Costs, Trust and transparency, Fast and Automated Claims Processing, Security and Fraud Prevention, and Customizable Policies.

Decentralized insurance represents a paradigm shift in the insurance industry, offering a more accessible, transparent, and efficient alternative to traditional insurance models. Despite specific challenges, like regulatory uncertainty, intelligent contract vulnerabilities, price volatility, and lack of traditional risk assessment data, decentralized insurance continues to gain momentum and attract interest from both users and investors.

Member-owned and member-governed structures:

Peer-to-peer (P2P) insurance involves member-owned and member-governed structures that differ significantly from traditional insurance models. Here is a closer look at how these structures operate:

1. Member ownership: Members own the platform or organization, often through a cooperative or mutual structure.

2. Collective decision-making: Members participate in decision-making processes, such as setting premiums, determining claims payouts, and electing governance boards.

3. Shared Risk: Members pool their premiums to cover each other’s losses, spreading Risk and reducing individual financial burdens.

4. Transparency: Members can access detailed information about the platform’s finances, claims, and operations.

5. Profit sharing: Surplus funds are distributed back to members as dividends or reduced premiums.

6. Community-driven: Peer-to-peer insurance is more than just a financial arrangement, it’s a community of like-minded individuals who share a common interest, profession, or demographic. This shared identity creates a sense of belonging and mutual support among members, enhancing their experience.

Use of technology and data analytics:

By leveraging these technologies, P2P insurance models can offer a more efficient, customer-centric, and sustainable alternative to traditional insurance models. This can lead to increased adoption and growth of the P2P insurance market, ultimately changing how we think about insurance.

1. Personalized insurance products tailored to individual needs

2. Increased transparency in pricing and claims processing

3. Cost savings through reduced administrative costs

4. Improved operational efficiency through automation

5. Enhanced customer experience through digital platforms and real-time communication

6. Increased trust through blockchain-based secure and decentralized data management

7. More accurate risk assessments through IoT and big data analytics

Personalized risk assessments and pricing: Personalized risk assessments and pricing in P2P insurance leverage advanced technologies such as AI, ML, IoT, and blockchain to create more accurate and fair insurance products. By collecting and analysing a wide range of data, P2P insurance models can tailor premiums to individual risk profiles, rewarding safe behaviours and encouraging risk mitigation. By leveraging technology and data analytics, P2P insurance can offer more precise and fair risk assessments, leading to a more sustainable and member-centric insurance model.

Advantages and Benefits: Peer-to-peer insurance has the potential to increase financial inclusion, offering insurance to previously underserved people. This can lead to increased efficiency and reduced costs; improved risk assessment and pricing; enhanced customer experience and engagement, making the audience feel hopeful and optimistic about the future of insurance.

Challenges and Limitations: Regulatory and legal hurdles, risk of adverse selection and moral hazard, Need for scale and critical mass, Potential for conflicts of interest.

Case Studies and Examples

Lemonade (US): Lemonade is an insurance company that uses a peer-to-peer (P2P) business model but with a twist. Like traditional insurers, it offers home, auto, pet, and life insurance, but it operates more autonomously and uses automation. Instead of returning unused premiums to policyholders, Lemonade donates them to the policyholder’s chosen nonprofit, totalling over $8.1 million in donations so far. This approach sets Lemonade apart from traditional P2P insurance models.

Friendsurance (Germany): Friendsurance is a German peer-to-peer insurance platform that allows users to form groups and pool their premiums to insure against various risks. Founded in 2010, it has gained popularity for its innovative approach.

Friendsurance connects users with similar risk profiles, allowing them to share premiums and benefits. The platform takes a flat fee, and the remaining funds are distributed back to group members or donated to charity. This model reduces costs and encourages community building. With over 100,000 users, Friendsurance has expanded its offerings to include health, life, and disability insurance. Its success demonstrates the Potential of peer-to-peer insurance to disrupt traditional models and create a more inclusive, community-driven approach to risk management.

Guevara (UK): Guevara, a UK-based peer-to-peer insurance platform, revolutionized the industry with its innovative approach.

Guevara, launched in 2014, allows drivers to pool their premiums and reduce costs. The platform uses a mobile app to track driving behaviour, rewarding safe drivers with lower rates. Guevara takes a flat fee, and the remaining funds are distributed back to members or donated to charity. With no claims fees or excess charges, Guevara has attracted a loyal customer base. Its disruptive model has forced traditional insurers to rethink their approaches, making Guevara a pioneer in the peer-to-peer insurance space. Despite ceasing operations in 2019, Guevara’s impact on the industry remains significant.

Other notable peer-to-peer insurance platforms include:

Tongjubao (China): Focuses on health and medical insurance, using a mutual aid model to cover medical expenses.

Uvamo (Brazil): Offers peer-to-peer insurance for motorcycles, cars, and other vehicles, focusing on community building.

P2P Insurance (Singapore): Provides a platform for individuals to pool and manage risks together, focusing on transparency and fairness.

Conclusion

Our findings are consistent with the notion that P2P insurance platforms have distinct characteristics compared to traditional insurance models. While P2P insurance platforms have lower premiums and higher user satisfaction. Our statistical analysis yields a significant p-value of policyholder age and location are significant factors influencing claims frequency and severity. Our research has significant practical applications for the design and management of P2P insurance platforms and highlight areas for further research. Traditional insurance relies on large, diverse pools of policyholders to spread risk. P2P insurance groups are often smaller and more homogeneous, which could impact risk distribution and stability. This research can provide data-driven recommendations policyholders, insurers, and regulators aiming to foster innovation while ensuring stability and fairness in the insurance market. Future research into P2P insurance models is essential for understanding their full potential and addressing the challenges they face. By exploring these areas, researchers can contribute to the development of more robust, efficient, and customer-centric insurance solutions that leverage the strengths of peer-to-peer dynamics. This research will not only benefit the P2P insurance sector but also provide valuable insights for the broader insurance industry, policymakers, and consumers.

IX. References

- Bowers, N. L., Gerber, H. U., Hickman, J. C., Jones, D. A., & Nesbitt, C. J. (1997). Actuarial Mathematics. Society of Actuaries.

- Denuit, M., Marechal, X., Pitrebois, S., & Walhin, J. F. (2007). Actuarial Modelling of Claim Counts: Risk Classification, Credibility and Bonus-Malus Systems. John Wiley & Sons.

- Gatzert, N., & Kosub, T. (2014). Insurers’ investment strategies under Solvency II: Implications of financial market dynamics and regulatory constraints. Insurance: Mathematics and Economics, 55, 81-96.

- P2P Market Research Reports. (2023). Global P2P Insurance Market Analysis.

- Braun A., Schreiber F., “The current insurance landscape: business models and disruptive potential,” Institute of Insurance Economics I. VW-HSG, University of St. Gallen, 2017.

- Cappiello A., “Digital Disruption and InsurTech Start-ups: Risks and Challenges” [in] A. Cappiello, “Technology and the Insurance Industry,” Palgrave Pivot, 2018.

- EIOPA, “Report on best practices on licensing requirements, peer-to-peer insurance and the principle of proportionality in an Insurtech context,” Luxembourg: Publications Office of the European Union, 2019.

- Friendsurance Cashback Bike Insurance Product Disclosure Statement (PDS), including Policy Wording, 2018

- 5. IAIS, “Issues Paper on the Increasing Use of Digital Technology in Insurance and its Potential Impact on Consumer Outcomes,” Consultation Draft 25 July 2018.